Get the free form 5394

Show details

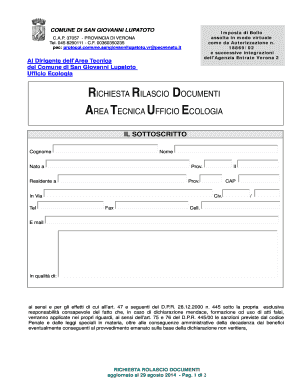

RESET For official use only Customer Name Customer No. PD F 5394 E Department of the Treasury Bureau of the Public Debt Revised April 2008 OMB No. 1535-0131 AGREEMENT AND REQUEST FOR DISPOSITION OF A DECEDENT S TREASURY SECURITIES Visit us on the Web at www. treasurydirect. gov IMPORTANT Follow instructions in filling out this form. You should be aware that the making of any false fictitious or fraudulent claim or statement to the United States i...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 5394 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5394 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5394 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fs form 5394. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out form 5394

How to fill out form 5394:

01

Gather all necessary information and documentation required for form 5394.

02

Carefully read the instructions provided with the form to understand the requirements and guidelines for filling it out.

03

Begin by filling in your personal information accurately, including your name, address, contact details, and any other required identification.

04

Proceed to complete the specific sections of the form based on the purpose of the form, such as employment history, financial information, or any other relevant details.

05

Ensure that all information provided is correct and up to date. Double-check for any errors or missing information.

06

If any supporting documents are required, make sure to attach them securely to the completed form.

07

Review the entire form once again to confirm that all fields are correctly filled, and all necessary documents are included.

08

Sign and date the form as required.

09

Make a copy of the completed form and all supporting documentation for your records before submitting it.

Who needs form 5394:

01

The specific individuals or entities who require form 5394 will depend on its purpose and the governing authority that mandates its use.

02

Generally, form 5394 may be needed by individuals applying for certain licenses, permits, benefits, or other official requirements.

03

It is essential to refer to the relevant regulations, guidelines, or instructions to determine who specifically needs to fill out form 5394 in a given context.

Fill form 5394 department of treasury : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out form 5394?

Form 5394 is an IRS form used to request a tax refund or credit from the United States government.

To fill out Form 5394, start by entering your personal information, such as your name, address, and Social Security number. Next, enter the tax period for which you are claiming the refund or credit. Enter the total amount of tax that you paid for the tax period and the total amount that you are claiming on Form 5394.

Next, enter the specific reasons for your claim on Form 5394. Reasons could include an overpayment of taxes, an adjustment of prior year taxes, a credit for tax payments made in error, or a refund for taxes paid in a prior year.

Finally, sign and date your Form 5394 and mail it to the IRS office in your state.

When is the deadline to file form 5394 in 2023?

The deadline for filing Form 5394 is April 15, 2023.

What is form 5394?

Form 5394 is used by the Internal Revenue Service (IRS) in the United States. It is known as the "Application for Central Withholding Agreements". This form is used by foreign persons or entities seeking approval from the IRS to enter into a withholding agreement related to U.S. source income. The purpose of this form is to establish a centralized withholding agreement to ensure proper tax withholding on specific types of income, such as income from real estate investments.

Who is required to file form 5394?

Form 5394, titled "Corporate Productivity Credit Project Rebuilding Form," is a form that is required to be filed by a corporation that seeks to be eligible for the Corporate Productivity Credit (CPC) under the United States Internal Revenue Code.

What is the purpose of form 5394?

Form 5394 is used by taxpayers to report certain information about their interest in, or authority over, specified foreign financial assets. The purpose of this form is to provide the Internal Revenue Service (IRS) with information to ensure compliance with the Foreign Account Tax Compliance Act (FATCA) and to help prevent tax evasion. Form 5394 may be required for individuals or entities who meet certain thresholds in terms of the value of their foreign financial assets.

What information must be reported on form 5394?

Form 5394, Report of Cash Payments Over $10,000 Received in a Trade or Business, is used to report cash payments received by a trade or business that exceed $10,000 in a single transaction or a series of related transactions. The following information is required to be reported on Form 5394:

1. Name, address, and taxpayer identification number (TIN) of the trade or business receiving the cash payment.

2. Date of the cash payment.

3. Amount of the cash payment.

4. Description of the goods or services exchanged for the cash payment.

5. Name, address, and TIN of the person or entity making the cash payment.

6. Purpose of the transaction.

7. If the cash payment was received in a foreign currency, the exchange rate used to convert the payment into U.S. dollars.

8. Any other relevant information about the transaction or the parties involved.

It is important to note that Form 5394 is typically used by businesses to fulfill their reporting obligations under the IRS's currency transaction reporting requirements. Failure to properly report cash payments over $10,000 may result in penalties or other enforcement actions by the IRS.

What is the penalty for the late filing of form 5394?

Form 5394 is used to apply for an extension of time to file Form 5500 series returns. If the extension is not filed by the original due date, there is no specific penalty mentioned for the late filing of Form 5394 itself.

However, it's important to note that the late filing of Form 5500 series returns (which the extension is applied for) may result in penalties. The penalties for late filing of Form 5500 series returns are specified by the Internal Revenue Service (IRS) and the Department of Labor (DOL). The exact penalties depend on various factors, including the type of plan, the number of participants, and the length of the delay.

It is recommended to consult the official instructions and guidelines provided by the IRS and DOL, or seek professional advice, to determine the specific penalties applicable in a particular situation.

How do I complete form 5394 online?

Easy online fs form 5394 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit fs5394 online?

The editing procedure is simple with pdfFiller. Open your pdf 5394 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit form pd f 5394 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form pdf 5394 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your form 5394 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

fs5394 is not the form you're looking for?Search for another form here.

Keywords relevant to fillable fs form 5394

Related to fs 5394 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.